Alpha as a Source of Return through Market-Neutral Opportunities and Adaptive AI

PSS CAPITAL

a quantum leap in wealth & asset management strategies

PSS Capital is your partner in cutting-edge asset management technology. Our highly specialized software provides hedge funds and institutional investors with a powerful multi-asset trading solution. Leveraging advanced algorithms, machine learning, and deep learning, we enable more precise, faster, and sustainable trading strategies that adapt seamlessly to the dynamic challenges of global markets.

Real Market Intelligence

in Real Time, Across All Market Conditions

Our technology sets new standards for speed and precision in asset management:

Real Time Data Processing

Our software continuously integrates market data, news, and blockchain information, providing institutional investors with up-to-the-minute insights for optimal decision-making.

Risk and Stress Management

Equipped with powerful tools for scenario analysis and real-time stress tests, our software ensures market-neutral strategies even under extreme market conditions.

Self-Learning Algorithms:

Machine learning and deep learning technologies empower our software to adapt automatically to market changes and enhance trading strategies autonomously.

Military-Grade Cybersecurity:

Our team, comprising experts in institutional trading and military-grade cybersecurity, ensures the highest level of protection for sensitive financial data.

The Founder

Over a Decade of Experience and Strategic Investment Optimization

With PSS Capital, institutional investors benefit from a platform that meets the complex demands of a globalized market while helping to minimize trading costs and maximize performance. Our solutions create a competitive advantage through speed, accuracy, and forward-looking strategies – a quantum leap in wealth & asset management. Experience the next generation of trading strategy and let PSS Capital lead you into a new era of financial management.

Christian R. Berger certified Investment Fundmanager

Certified Investment Fund Manager (Frankfurt School of Finance):

As a certified Investment Fund Manager, Christian Berger brings in-depth expertise in professional fund management and structured investment administration.

Honors Graduate from the Theresian Military Academy:

With an academic focus on strategy and tactics from the world’s oldest military academy, he applies an uniquely tactical approach to market analysis and risk management. Development of the PSS Capital Alpha Strategy has been underway since 2017.

Strategic Development Experience at a Wall Street Asset Management Firm:

Having worked with a leading Wall Street institution, he not only gained invaluable insights into the strategic management and analysis of large asset portfolios but continues to maintain close connections with Wall Street. This ongoing engagement ensures he remains at the forefront of industry developments and market dynamics.

Christian R. Berger certified Investment Fundmanager

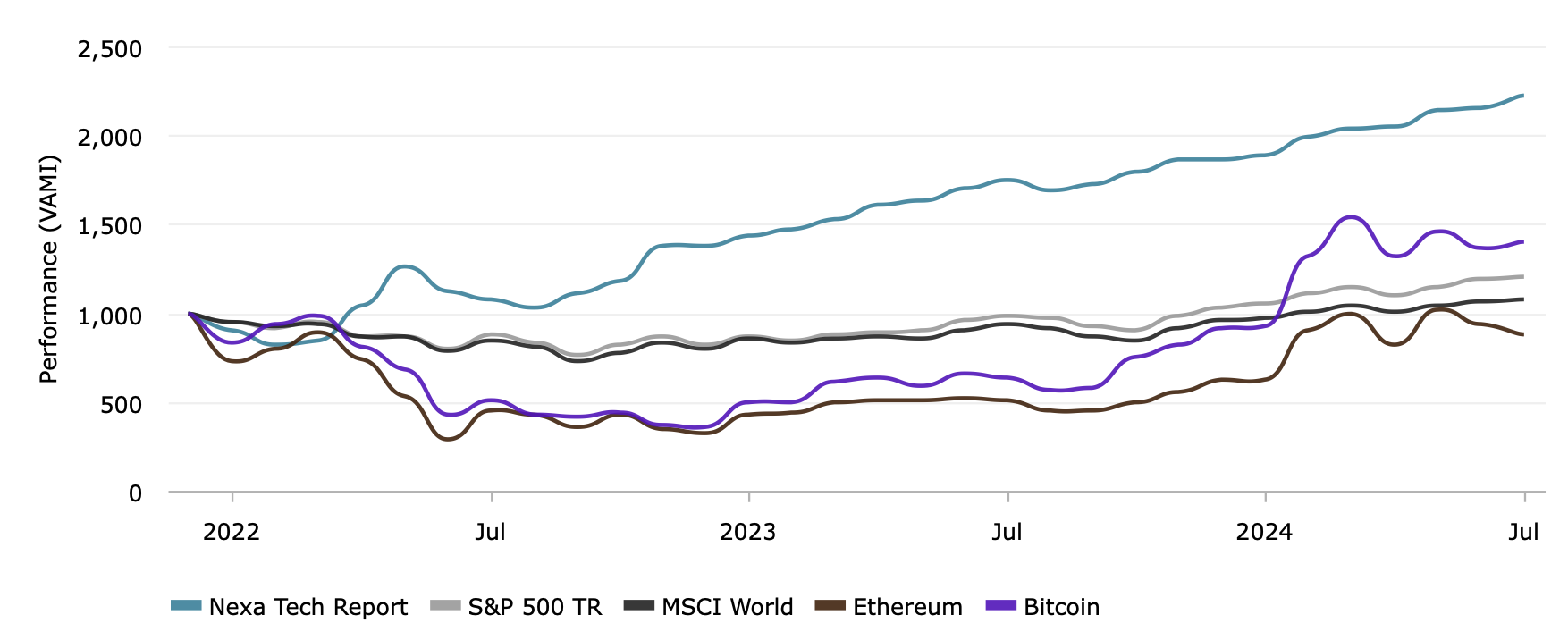

Our Flagship: NEXATRADE

"An Alpha Strategy Uniting Innovation, Stability, and Performance"

Discover an innovative investment strategy that combines market neutrality with cutting-edge AI technology across multi-asset platforms. Designed to deliver consistent returns and targeted risk minimization, this strategy offers an attractive opportunity for investors seeking stability and performance in a challenging market landscape.

Market-Neutral Positioning:

Through dynamic long and short positions in crypto markets and U.S. futures, we actively mitigate risk and secure stable returns, regardless of market fluctuations.

Adaptive AI Technology:

Our advanced AI continuously analyzes market data, learning and adapting to evolving market conditions for optimized performance and stability.

Strategic Thinking and Precision Tactics:

Combining strategic expertise with deep market understanding, the strategy is managed confidently, even in highly volatile market phases. NEXA is specialized in US Futures, Crypto, Forex and Commodities.

Our ALPHA

Revolutionizing Wealth Management: Stability, Innovation, and Performance in Any Market

Alpha as a Source of Return through Market-Neutral Opportunities and Adaptive AI

Independence from Market Trends:

Alpha here is generated through marketneutral positions that yield returns independent of overall market direction. Gains are achieved by capitalizing on inefficiencies and short-term anomalies in the crypto markets and U.S. futures, without reliance on bullish or bearish trends.

Efficient Risk Diversification through Long and Short Positions:

Employing a long-short approach significantly reduces risks from macroeconomic impacts and market fluctuations. This positioning generates alpha based on the relative performance of assets, backed by robust risk management practices.

AI-Driven Market Opportunities:

The adaptive AI model continuously analyzes historical and real-time data to recognize patterns and trends. By identifying market inefficiencies and short-lived opportunities, the model generates consistent alpha. It optimizes its decision-making in real-time, allowing for flexibility in response to both minor price movements and major market shifts.

Strategically Optimized Volatility:

Alpha in this strategy remains stable as it isn’t dependent on broad market movements. Instead, it’s driven by strategic adjustments and tactical positioning in assets with uncorrelated or weakly correlated return sources. This approach ensures stable alpha generation, even in volatile markets.

Contact

Your contact person:

Isabella

© PSS Capital

In diesem Kurzvideo erfährst du, was dich erwartet, wenn du dich für den WSV Starter Plan entscheidest:

In diesem Kurzvideo erfährst du, was dich erwartet, wenn du dich für den WSV Professional Plan entscheidest: